Is your business safe from invoice fraud? Despite technological advancements in security, invoice fraud continues to be a pervasive issue that costs businesses millions each year. This form of financial deception involves the manipulation or fabrication of billing documents to divert payments or illegitimately extract funds. Not only does it pose a significant financial risk, but it also erodes the trust between businesses and their stakeholders.

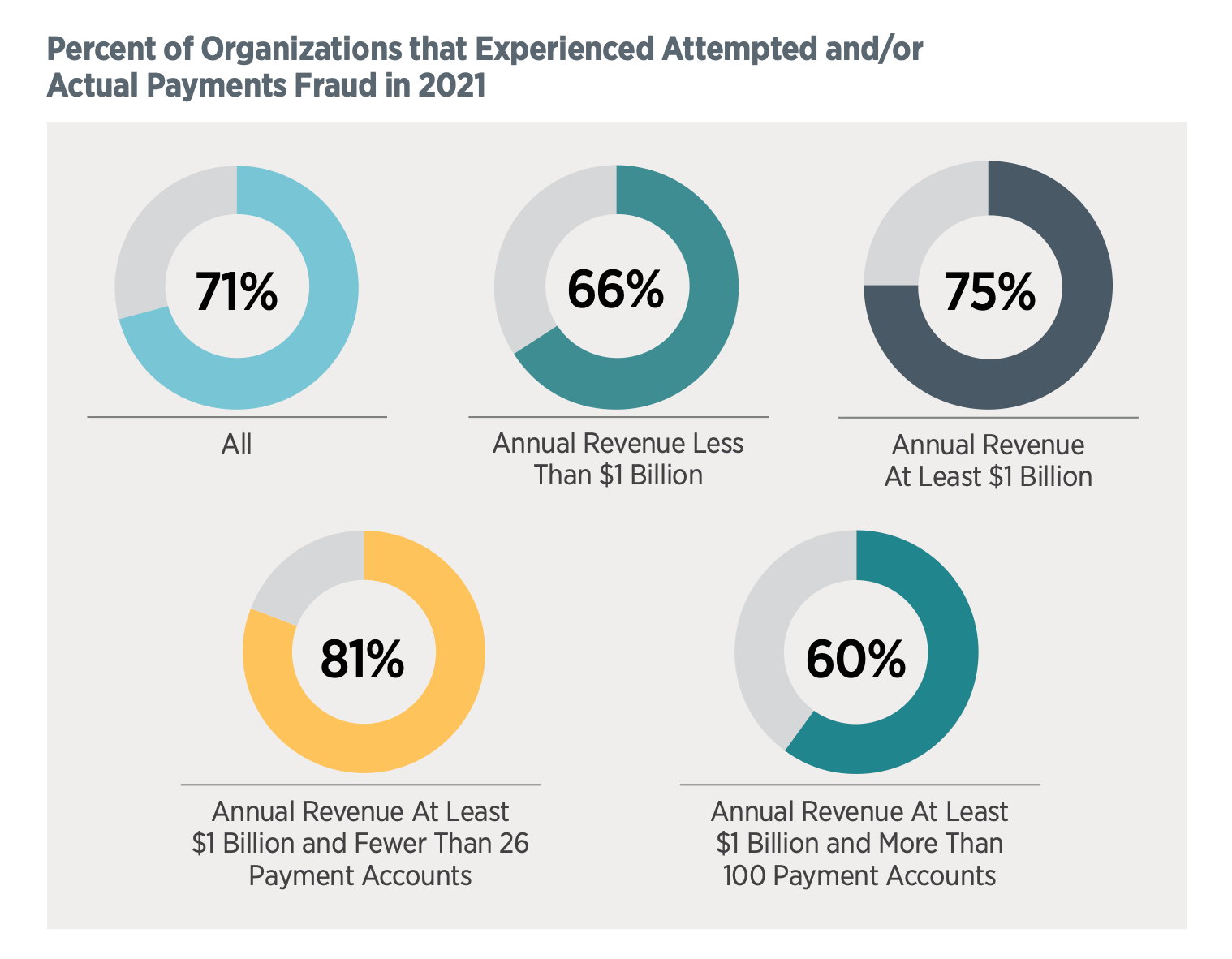

The 2022 AFP (Association for Financial Professionals) Payment Fraud and Control Report revealed that 71% of companies were victims of attempted or actual payment fraud in 2021. This figure is down 3% from 2020, which may sound encouraging. But, the reality is that invoice fraud remains a major threat.

Regardless of size or industry, businesses must remain vigilant to protect themselves and customers from fraud risks. Whether it is social engineering to compromise sensitive information or creating a look-alike domain to impersonate vendors, fraudsters are constantly finding creative ways to commit invoice fraud.

Considering these dangers, businesses must ensure they have fraud control measures. Robust callback processes and validation procedures are critical to maintain resiliency and prevent loss.

What is Invoice Fraud?

(Source)

Invoice fraud is a scam where fraudsters impersonate legitimate vendors or suppliers to deceive customers into paying for fake invoices. These fraudulent activities can take many forms, such as phishing emails or even phone calls.

The scammer aims to trick the business into transferring funds to their accounts – and these fraudsters have evolved over the years to become increasingly sophisticated.

Many fraudulent invoices look like the real deal, complete with company logos, total fees, products, services, and even legitimate email addresses.

For example, a scammer might impersonate a vendor and send a fake invoice to a customer for goods or services that were never provided.

The impact of invoice fraud can cause significant financial and reputational damage. So it’s vital that your business knows how to spot red flags and shares the signs with customers to avoid them falling victim to fake billers.

5 Red Flags to Identify Fake Billers

1. Unexpected Invoices

An unexpected invoice occurs when a vendor sends a customer a bill for products or services they didn’t order. It could even be an invoice from a vendor submitted before the invoice’s due date. In any case, these invoices must be scrutinized.

Customers should be suspicious whenever they receive an invoice from a vendor with the slightest discrepancy. Even if it’s missing a number or letter, or the colors don’t match the usual invoice, it’s always worth verifying with the vendor.

Fraudsters have been known to con businesses into paying for invoices that do not exist by manipulating minor details they expect to go unnoticed.

If you cannot verify an invoice’s authenticity, it is best not to pay until you have investigated further. Moreover, you should ensure your accounts payable department has robust processes for verifying all invoices and checking bank details before making any payments.

Another solution is to use fax cover sheet templates, especially in industries like health, legal, or manufacturing, that require the utmost security. These sheets also ensure consistency, typically including company branding elements like logos, colors, and fonts.

In doing so, businesses create a recognizable and trusted visual identity. As a result, customers can identify legitimate faxes from your company, making it harder for fraudsters to impersonate the organization and manipulate invoice-related communications.

2. Unusual Payment Instructions

Scammers may try to convince businesses to send payments to a different account by citing various reasons. For example, they might claim that their bank account is under audit or they have set up a new account for faster processing.

These requests should be confirmed by contacting the vendor or supplier directly using a verified phone number or email address. Training employees to recognize and report suspicious activity promptly is also essential.

For example, a business might receive an invoice with instructions to make payment via a non-standard method such as a Discord-protected cryptocurrency wallet, raising red flags and leading to the discovery of the fraudulent activity.

3. Pressure Tactics

Fraudsters often use fear and urgency to pressure businesses into quick payments without verification. They may threaten to cancel services or take legal action if payment is not made immediately.

It’s essential to stay calm and not let such tactics cloud your judgment. Always double-check the invoice and payment details before making any payments.

Furthermore, scammers may send emails with urgent subject lines to prompt immediate action. They may also use high-pressure language and insist on immediate payment without proper documentation or proof of services rendered.

It’s crucial to be wary of such tactics and verify the authenticity of the invoice and request before making any payments.

Educating employees and customers on these tactics and providing clear guidelines for handling urgent payment requests can prevent invoice fraud.

In addition, encouraging staff and clients to report suspicious activity or requests can help identify and prevent future fraud.

4. Invoice Discrepancies

Discrepancies between invoices and prior agreements or contracts can be a red flag when identifying fake billers.

Invoice scammers may send invoices for goods or services not agreed upon in a previous contract or agreement – for instance, if you have an agreement with a client to provide a specific service at a set price. However, receiving an invoice for a different service or at a higher price could be a red flag.

Ensure your customers know to review all invoices to ensure they comply with contracts and agreements. If they notice any inconsistencies, they should investigate further and contact your team to clarify the situation. Maintaining accurate records of all contracts and agreements can help identify and prevent fraudulent invoices.

Moreover, irregular invoice details, such as incorrect billing, shipping addresses, or misspelled company names, are also warning signs. Scammers may use these tactics to trick companies into paying for goods or services never provided.

PBX phone systems can be handy with their call recording feature. Businesses can track invoice conversations by enabling call recording for specific extensions or departments involved in financial transactions.

In case of a suspicion of fraudulent activities or disputes, these recordings can be reviewed to identify any inconsistencies or discrepancies.

In addition, implementing a two-step verification process, such as requiring approval from a manager or supervisor before making payments, can add an extra layer of protection.

Before you pay, make sure what a professional invoice looks like.

5. Suspicious Email Address

One of the telltale signs of a scammer is a suspicious email address. Fraudsters often use email addresses similar to legitimate vendors or suppliers but with slight variations that may go unnoticed at first glance. For example, they may use a different domain name or add extra characters to the address.

As an SMB owner or manager, it’s essential to be vigilant when reviewing invoices and payment requests. Always validate the sender’s email address and compare it to the vendor’s or supplier’s email.

Use email filters to flag suspicious emails and prevent them from reaching your inbox or spam folder. In addition, educate customers and other partners about how taking hosting seriously can make life easier for everyone.

Why? Because domain registration allows you to set up email addresses associated with your domain, such as info@yourbusiness.com. Implementing email authentication protocols, such as SPF (Sender Policy Framework) or DKIM (DomainKeys Identified Mail), helps verify the authenticity of emails sent from your domain.

This authentication can prevent fraudsters from spoofing your domain and sending fraudulent invoices or phishing emails to deceive customers.

Common Types of Invoice Fraud

Now that you know how to identify fake billers trying to target your customers, let’s discuss the common types of invoice fraud.

Third-Party Invoice Fraud

Third-party invoice fraud involves an outside party creating and submitting fraudulent invoices to a company to receive payment. Detecting this type of fraud can be tricky because the fraudster uses legitimate documents.

An example of third-party fraud is one we mentioned above, where a fraudster impersonates a vendor and invoices for services not rendered. Another instance is when a hacker gains access to a company’s system and creates fraudulent invoices using information from actual vendors. In both cases, the business unknowingly pays the false invoices, resulting in financial loss.

In some cases, the external party may be colluding with someone who already has access to the business’s system, like an employee. So, you need to vet your people and put strict processes in place.

Learn the right way to make an invoice.

Duplicate Payment

Duplicate payment means paying twice or more for the same thing. It happens when two payments are made for the same invoice. This can be a genuine error or fraud. Either way, a company can lose a lot of money.

Many fraudulent billers employ double invoicing as a tactic to illicitly receive extra payments from unsuspecting clients.

One way duplicate payments can occur is if an employee unknowingly enters the same invoice into the system twice. Perhaps they don’t realize the invoice has been sorted, and they enter it again.

Another way it happens is that a vendor sends an invoice twice. This typically occurs when a payment delay could lead to a vendor sending an invoice again.

In other cases, fraudulent vendors might submit multiple invoices for the same product or service in order to receive more money than they are entitled to.

Discover how to select the appropriate payment method.

Labor Mischarging

Labor mischarging happens when an employee or contractor charges for more hours than they actually worked. This can happen intentionally, with the individual pocketing extra money, or unintentionally due to poor record-keeping or miscommunication.

For example, an employee may inflate their hours to look more productive or hit specific targets. Alternatively, contractors may pad their invoices by including additional workers who did not work on the project.

Meanwhile, some employees may accidentally charge time for the wrong projects or tasks without realizing it until it’s too late.

Labor mischarging results in financial losses for companies and damages trust between employers, employees, contractors, customers, and vendors.

Inferior Products or Services

In inferior products or services invoice fraud, fraudster vendors might offer products or services of poor quality or fail to meet the agreed-upon standards. This can occur when a fraudulent vendor cuts corners to save money or lacks the skills or resources to deliver the promised products or services.

Fraudsters may even use fake credentials or certifications to make their products or services appear legitimate. Companies must carefully vet vendors and verify their certifications’ authenticity before engaging in business transactions.

Internal Fraud

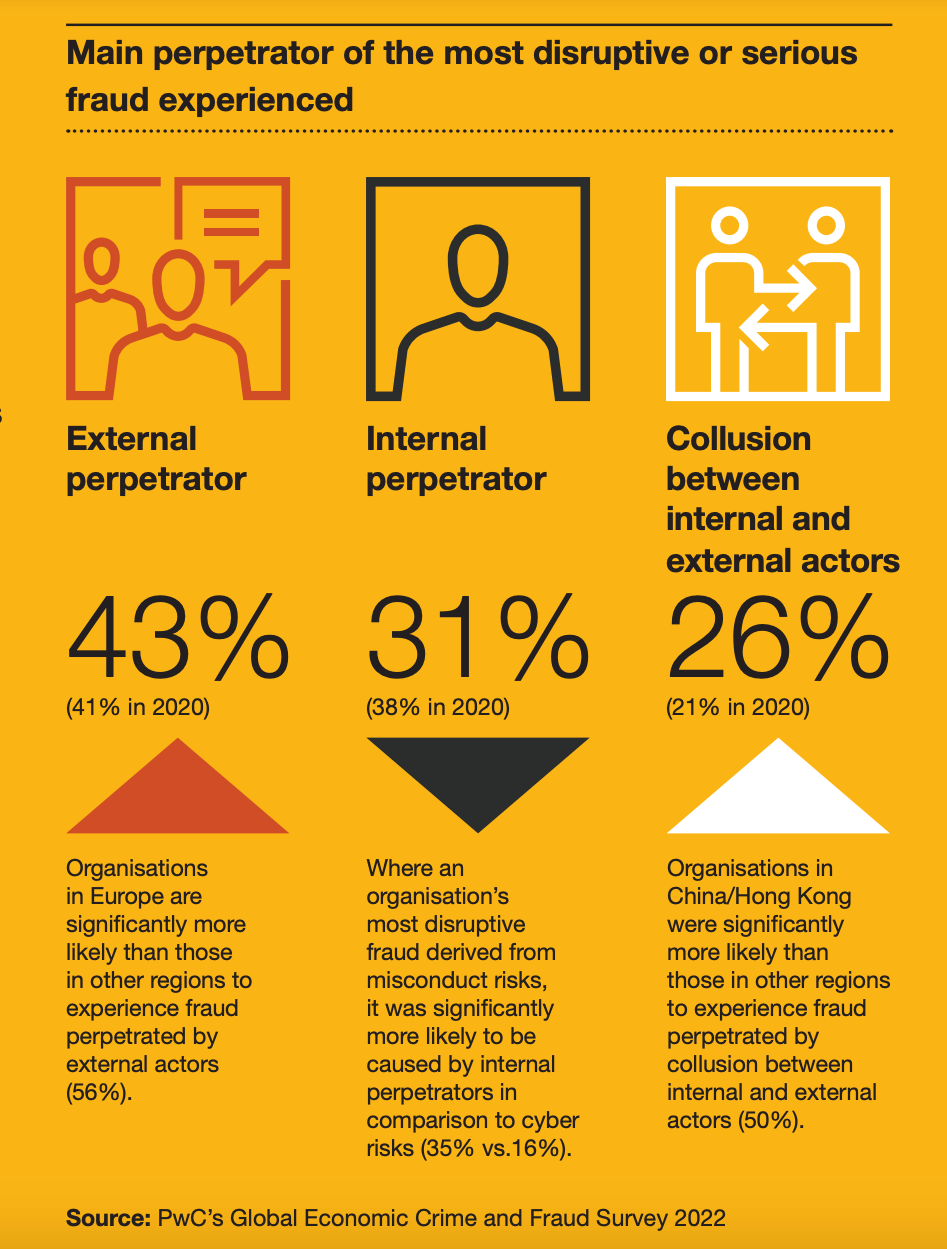

According to PWC’s 2022 Global Economic Crime and Fraud Survey, internal fraud is the second most common type of fraud. Although it dropped by 7% in 2021, it still accounted for 31% of all fraud cases.

(Source)

(Source)

Internal invoice fraud is when a company employee creates fraudulent invoices and approves them for payment. This kind of fraud can be challenging to detect because the employee responsible for the theft has access to all the necessary information and controls the approval process.

In certain situations, employees may conspire with outside parties to commit fraud, making it even more tricky.

It’s essential to create a culture of honesty and integrity within the organization to minimize the risk of internal fraud.

Strategies to Protect Customers from Invoice Fraud

Here are four strategies to protect customers from invoice fraud.

1. Customer Education

When you educate your customers, you reduce their odds of falling victim to scams. Provide them with information about common invoice fraud scams, like phishing, ransomware, BEC, and EAC. Encourage them to scrutinize any invoice they receive and double-check unusual payment requests or billing detail changes.

You should also encourage them to take preventative measures. For instance, healthcare practices should invest in a HIPAA compliant VoIP service.

This service will not only protect their patient’s data but also ensure that voice calls, including discussions related to financial matters or invoices, are encrypted and transmitted securely over the internet.

Encryption helps protect the confidentiality of the information shared during conversations, reducing the risk of interception by unauthorized individuals who may use that information for fraud.

2. Invoice Verification Procedures

Encourage clients to implement a system that verifies invoice authenticity before approving payment. This can include checking invoice details against the company’s records, confirming the vendor’s identity, and verifying the product or service provided.

Invoices should also be processed only by authorized personnel and checks and balances should be in place to prevent fraud and errors.

Implementing a virtual cyber assistant can enhance invoice verification procedures by automating the verification process, flagging suspicious invoices for further review, and ensuring consistency in the authentication of invoices.

3. Two-factor Authentication

Requiring multiple levels of approval before paying can prevent fraud. Two-factor authentication adds an extra layer of security by requiring a code or password and a username and password. This can help prevent unauthorized access to payment systems and reduce fraud risk.

4. Regular Audits and Previews

Ongoing audits and reviews of financial records can help identify discrepancies or irregularities that may indicate fraud. This can include reviewing vendor contracts and payment histories, comparing invoice amounts to agreed-upon prices, and verifying the accuracy of financial statements.

Stay Vigilant and Protect Yourself From Fraud

Invoice fraud is a serious issue that affects businesses of all sizes and industries. Fake billers target customers with sophisticated scams that are difficult to detect.

Educating yourself, your team, and your clients about warning signs, such as suspicious email addresses or unusual payment requests, is imperative for protecting your customers and your business from this type of financial crime.

Remember: vigilance is vital to fighting invoice fraud. Stay alert, informed, and safe!

Steer clear of invoice fraud with Billdu!

Don’t let invoice fraud undermine your business. With Billdu, you can secure your transactions and ensure that each invoice you send or receive is legitimate. Our advanced security features are designed to keep scams at bay, providing you with peace of mind.