Whether you are starting a startup or been operating for many years, you know that managing small business finances is essential if you want to keep your business growing. And, yet this is the one area many small businesses struggle to maintain. However, handling your small business finances can be done efficiently once you put your mind to it.

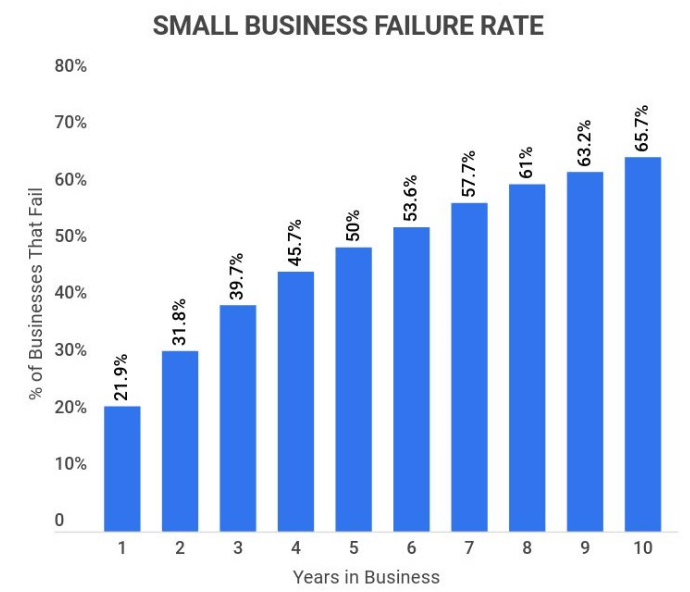

Ask most entrepreneurs what’s their biggest challenge and they’ll likely tell you financial management. When your company’s finances are in a mess you can expect your business to limp along or at worse, fold because of poor financial management— 66% of small businesses fail within 10 years of inception because of inefficient financial management.

However, when you know how to plan small business finances, you’ll be well-informed about how your company is performing and why.

Financial management allows you to see the bigger picture while achieving daily financial objectives at the same time. Knowing how to plan your small business finances also gives you the key to making the best operating decisions in a proactive and constructive way.

If you’re looking for ways to improve your small business financial management system, read on as we share some tips for managing your company’s finances. By using these ideas, you can run your business knowing its financially healthy and expanding.

If you want to learn how to scale your small business during a recession, read the following article.

Advantages of excellent Financial Management for Small Businesses

For many small business owners, employing an accountant or bookkeeper full-time is a luxury in the early days of starting up. This is when you, as the business owner, need to educate yourself around the basics of accounting so you can keep your financial management systems running smoothly.

It’s also essential to be well-organized. This means keeping your paperwork in order and tracking all your income and expenses throughout the year. Strong money management includes issuing and following through on invoices issued to customers, filling all receipts for expenditures, and reviewing your cash flow on a regular basis.

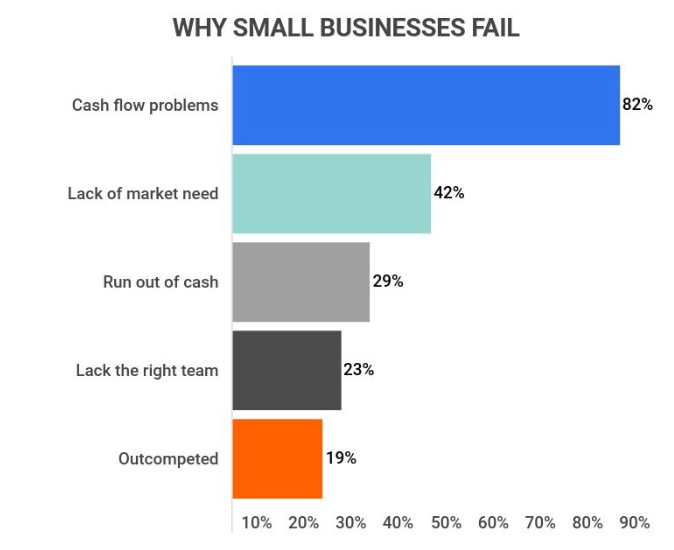

Research shows that 82% of small businesses fail because of cash flow problems. Additionally, 29% of small businesses fail because they run out of cash. This problem also stems from a lack of understanding of the cash flow.

Smart financial management has many benefits for small businesses. Besides it being common sense, managing your finances properly as a small business owner means you can:

- Keep your company stable and growing instead of it failing because of poor cash flow management.

- Fulfill your obligations towards employees’ salaries and pay yourself every month.

- Maintain a heathy credit rating which makes it easier to apply for business loans if and when you need to.

- Keep the books in good shape for better financial reporting and tax returns.

- Plan ahead to keep operations going even during difficult times.

- See where your business needs improvement whether it’s in sales, better administration, or keeping costs down in certain operational areas.

By managing your small business finances in a smart and proactive way, you’re giving your company a strong financial footing to grow in the future.

14 Smart Tips for Managing Small Business Finances

Here are 14 smart tips to manage small business finances so you can rest assured your company will grow and remain stable even during challenging times.

1. Pay Yourself a Salary

It’s very tempting to put all your earnings straight back into your business without compensating yourself for all your time and hard work. This is a mistake many startup entrepreneurs make when not paying themselves a salary.

Having your own salary means you can still keep your personal financial needs in good shape. Running your own business finances and keeping them in order can be stressful so you don’t want to be worrying about your own personal finances as well. Always pay yourself as well as others working in your business.

You can base your salary on several factors. These include the net income of your business, industry salary standards, personal expenses, taxes, and so on. You also need to factor in the industry, company size, and region. The average salary of a small business owner in the UK is $37,290. While in the US it is $69,429.

You can define a percentage of the net profits as your annual salary. Or you can define a fixed salary amount that becomes a part of the company’s recurring expenses.

2. Take Advantage of Loans

For many people, the prospect of taking out a loan for their business can be scary. However, with good business and financial planning, a loan could be the cash injection you need to get your business off the ground.

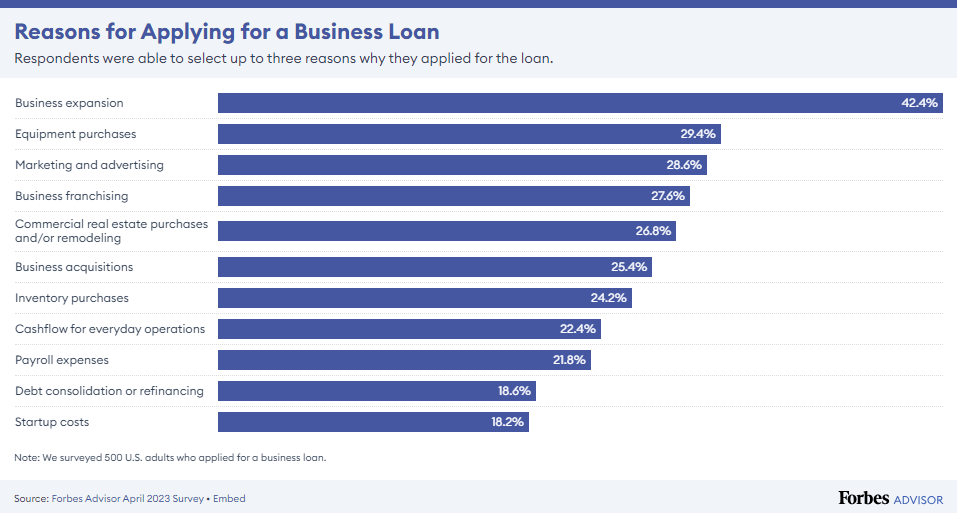

Small businesses may draw loans for several different reasons. The majority of small businesses (42%) take loans to expand their business. Other common reasons include investment in specific areas of operations such as technology, inventory, marketing, and so on.

(Source)

(Source)

Capital from loans allows you to invest in the necessary equipment to manufacture your products, employ more staff, or keep your cash flow going while paying out suppliers and other vendors. It’s essential you source a loan with good interest rates so do your homework before taking out loans with any institution.

3. Keep a Good Credit Rating

When taking out a loan, make sure you pay it back regularly. This is one of the ways to build up a good credit rating or record.

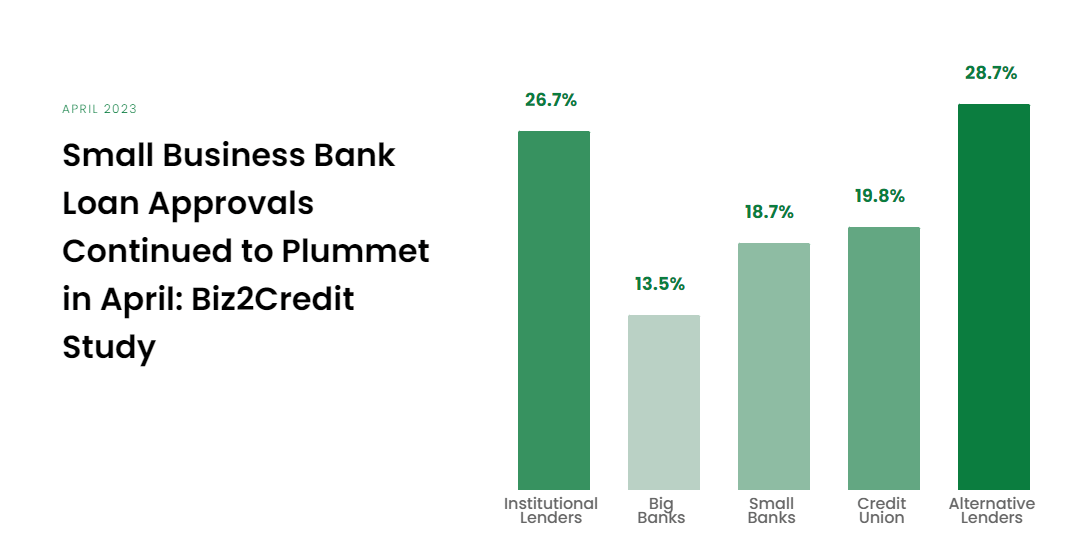

It is difficult for small businesses to get financial assistance. A report by the World Bank states that it is far more difficult for small businesses to obtain loans compared to large firms. The loan approval rate for small businesses remains below 30%.

This means more than 70% of small business loan applications are rejected. Among these, 20% of small business loans are denied because of poor business credit. Hence, you need to maintain and attempt to improve your business credit score.

Banks are more inclined to support small businesses who manage their credit properly. The criteria for this differs from country to country. However, a few practices are recognized around the world for improving business credit scores. These include:

- Use a business account

- Pay bills before the deadlines

- Take small loans that you can easily pay off

- Pay higher than the minimum due amount for installments

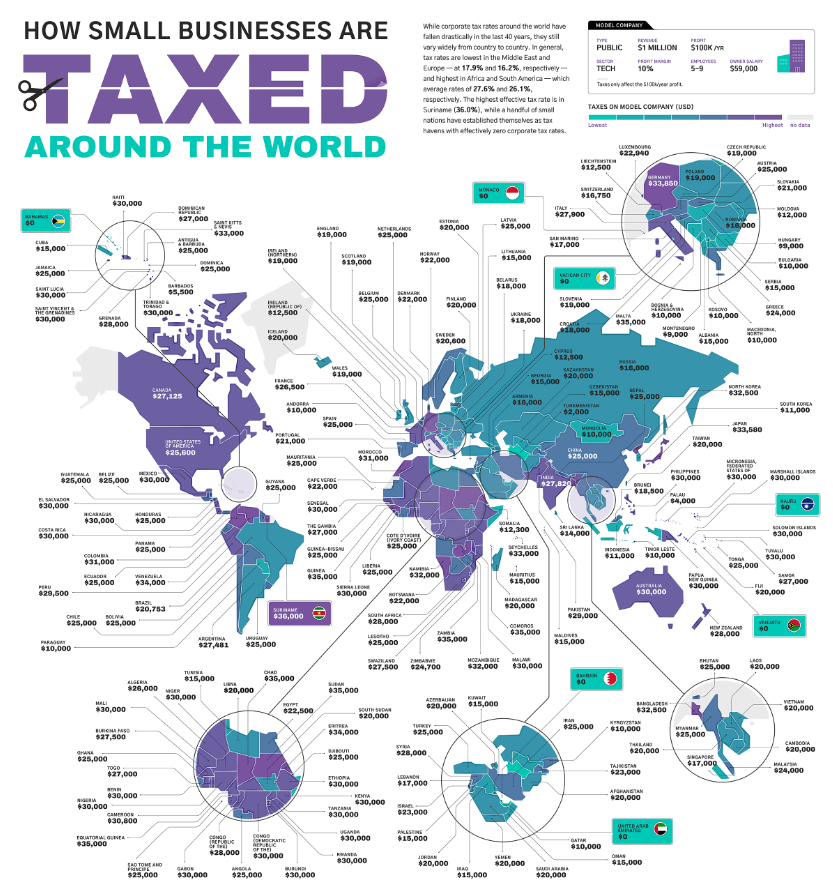

- Ensure compliance with taxation laws

A good business credit record means you can take out loans more easily, purchase commercial properties for your business, and increase your insurance policies. It can also help negotiate better terms with lenders when you seek financing. Furthermore, a good credit score is an indicator of a financially healthy company and can help you in several aspects of business management.

4. Get Familiar With Your Books

If you have a bookkeeper or accountant managing your books, arrange to have regular financial meetings with them. This way, you’ll have a clearer idea of how well your company is doing financially. Being astute with your business finances allows you to understand how your company is performing and why.

Get into the habit of checking your own business finances every day even if you do have a bookkeeper. Setting aside some time for daily monitoring of your books means you’re well-informed of all income and expenditures. It also means you can catch any financial problems early on and do something about it before it becomes a serious issue.

5. Leverage Multiple Bank Accounts

Small businesses also use multiple bank accounts to protect themselves from market risks such as bank failure. More than 55% of small businesses have more than $50,000 in the bank and 23% of them have deposits larger than $250,000.

If a business puts all its deposits in one account, it has little security in case of bank failure. Different banks and government agencies have a cap on guarantees in such events. For instance, the Federal Deposit Insurance Corporation (FDIC) of the U.S.A. provides coverage of up to $25,000 in case of bank failure.

(Source)

(Source)

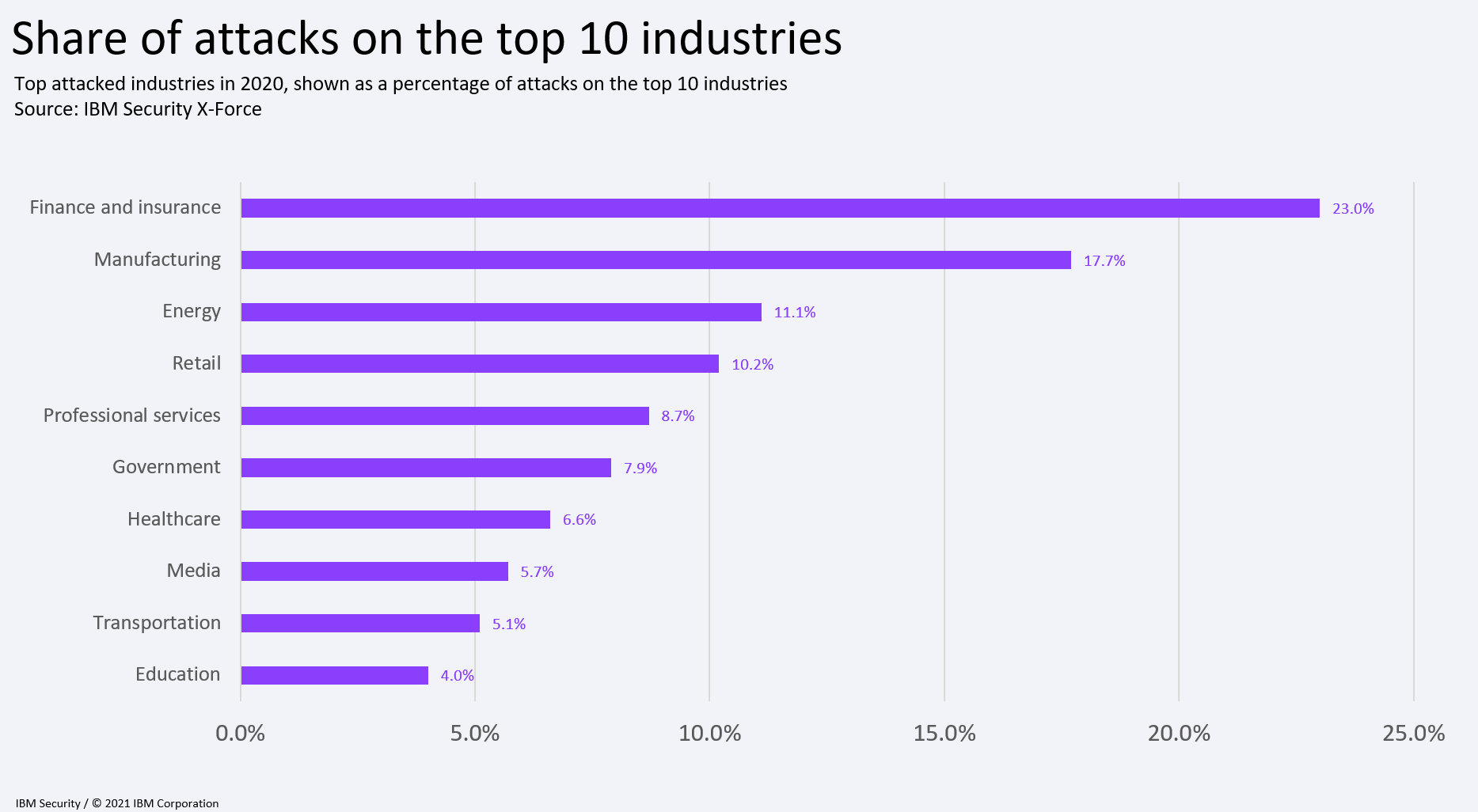

Financial institutions including banks are a major target for cyber attacks. Keeping multiple bank accounts also serves as a hedge against cyber-attacks. Most small businesses also use online tools and services. As a result, a business account is exposed to various cyber threats. Distributing your funds across multiple bank accounts and regular vulnerability assessments can help you control the damage caused by such attacks.

6. Develop a Smart Billing Strategy

One of the most essential components of your business is issuing invoices to your customers. If this is not done regularly and professionally, you’re going to battle to collect payments. While manual invoicing may seem like the simplest way to issue invoices, finding alternative smarter ways of creating and sending invoices will save you time and money as your business grows.

Automated invoicing such as Bildu’s online invoice generator simplifies the process of creating and issuing invoices while helping you track and collect payments from your customers. Our software allows you to generate estimates, proforma invoices, delivery notes, and purchase orders. Plus, you can also manage recurring invoices more efficiently with an online invoice maker.

Developing a smart billing strategy with an automated invoice processing system has many benefits including:

- Faster and more regular payments while tracking outstanding payments due to you for a better cash flow

- More professional invoices that’ll impress your customers

- Easier payment methods for your customers

Managing your income from invoices means you’ll have a healthier cash flow for your business to operate with.

7. Track Your Expenditures

Mapping expenses is as important for small businesses as mapping income sources, maybe more. That is why you need a detailed analysis of your outgoing cash flows to plan your finances.

You need to categorize your expenses based on their purpose. You can use the following three categories:

- Operational: Expenses concerned with running day-to-day operations.

- Financial: Expenses concerned with business funding.

- Investment: Expenses concerned with business assets.

- Regulatory: Expenses concerned with taxation and compliances.

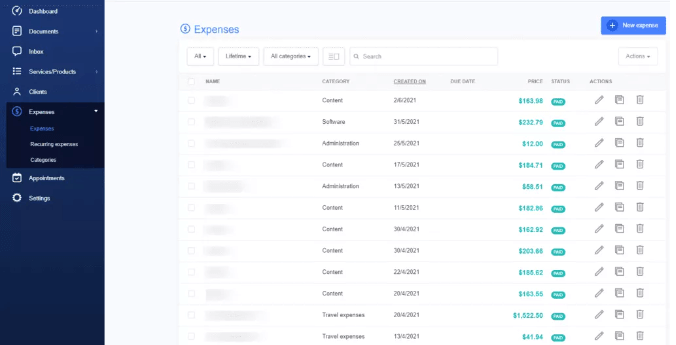

An automated invoicing system is another way of keeping an eye on all your expenses. The online system allows you to audit your expenses regularly while reviewing how and why your money is being spent. Online expense management, similar to issuing automated invoices, also saves you time and money by capturing all expenditures into one place for easy monitoring and financial reporting.

By automizing your expenses, you’re simplifying the whole process of capturing all the paperwork such as those bills and receipts piling up on your desk! You’ll also have all your income and expenses online, in one place, making it easy to see how your business is performing with quick and informative financial reports and charts.

8. Produce Regular Financial Statements

Financial statements are another important aspect of managing small business finances. If you’re hiring an accountant, they’ll be producing monthly financial statements. However, if you’re managing all your business finances then you’ll need to find out how to put together financial statements. These include a cash flow statement, your income statement, and a balance sheet.

Monthly financial statements allow you to act proactively and make the right operational decisions for your business. They also make it easier to produce financial reports when applying for business loans or preparing for tax return submissions.

Financial statements can be produced using an automated accounting system. Once again, this is a time-saver tool to consider especially if you want to spend more time focusing on other aspects of your business while keeping an eye on the financial side of your operations.

9. Invest in Growing Your Business and Plan Ahead

Wherever possible, keep money aside for potential investment in growing your business in the future. This may seem challenging in your first days as a startup but the sooner you can do this, the better placed you’ll be for planning ahead and encouraging the expansion of your company.

For instance, if you are a small e-commerce business, you can invest in technology and software such as an order fulfillment system for faster delivery to meet customer demands. On the other hand, if you are a tech startup, understanding and incorporating the NIS2 objectives and implementation can provide a vital step towards ensuring essential security measures such as Zero-Trust to protect your company and customer data.

If you’re able to show you can invest in growing your business you’ll reap the following benefits:

- A business that has a strong sense of financial direction and focus is more likely to thrive and become a stable company.

- You’ll be able to employ better quality employees who want to work with a business that shows potential for growth and expansion in the future.

- Loyal customers who value a business that’s committed to growing into the future while improving their services and products.

- Happy employees who know they’re working for a business that wants to grow and safeguard their own careers as well.

How to plan small business finances includes factoring in the potential of investing in opportunities further down the line that’ll expand your own company’s reach in its field. When working with your business finances always look ahead five to ten years so you stay ahead of your competitors.

10. Plan for Financial Flexibility

Financial flexibility refers to the ability to control your cash flow based on the circumstances. It concerns both revenue and expenses. The central idea of financial flexibility is to reduce dependence on internal and external factors.

If your company is dependent on only one source of revenue or specific resources for operations, then you have little protection against risks. For instance, if your supply chain is dependent on a single supplier, then your company’s financial health can suffer significantly if the supplier suddenly raises the price.

You can achieve financial flexibility for your business by diversifying your revenue streams and expenses. With regard to revenue streams, you can develop cash reserves, invest in liquidatable assets, build revenue from non-operational sources, and so on.

Bringing financial flexibility for expenses is even more important. 43% of small businesses find it challenging to pay operational expenses. And labor costs occupy the highest segment of small business expenses with a 70% share.

For flexibility in expenses, you can diversify the expenses between in-house and external resources to reduce dependency on either. Even with external resources, you can distribute the operations between two or more vendors.

These practices would facilitate you with the freedom to change the course of your business as needed. By reducing dependence, you will be better positioned to negotiate favorable terms for your business. Financial flexibility can help you make your small business more agile and adaptable to market changes and more resilient against risks.

Optimize your invoicing process with Billdu!

Invoicing, expense tracking, quotes, automation.

Learn why Billdu is one of the most popular invoicing apps in Australia.

(

(