No one likes fine print – not even those who have to write it. Invoice payment terms and conditions are particularly problematic, especially for small businesses trying to set them up for the first time. Unfortunately, they’re vital in ensuring that your clients understand your payment terms and schedule and that you get paid on time.

So to make sure your bottom line doesn’t suffer, we’ve created this article about understanding invoice payment terms. On top of all the necessary explanations, you’ll also find invoice payment term examples below, which you can customize to your company’s unique needs.

And now, without further ado, let’s jump right in.

Key Takeaways

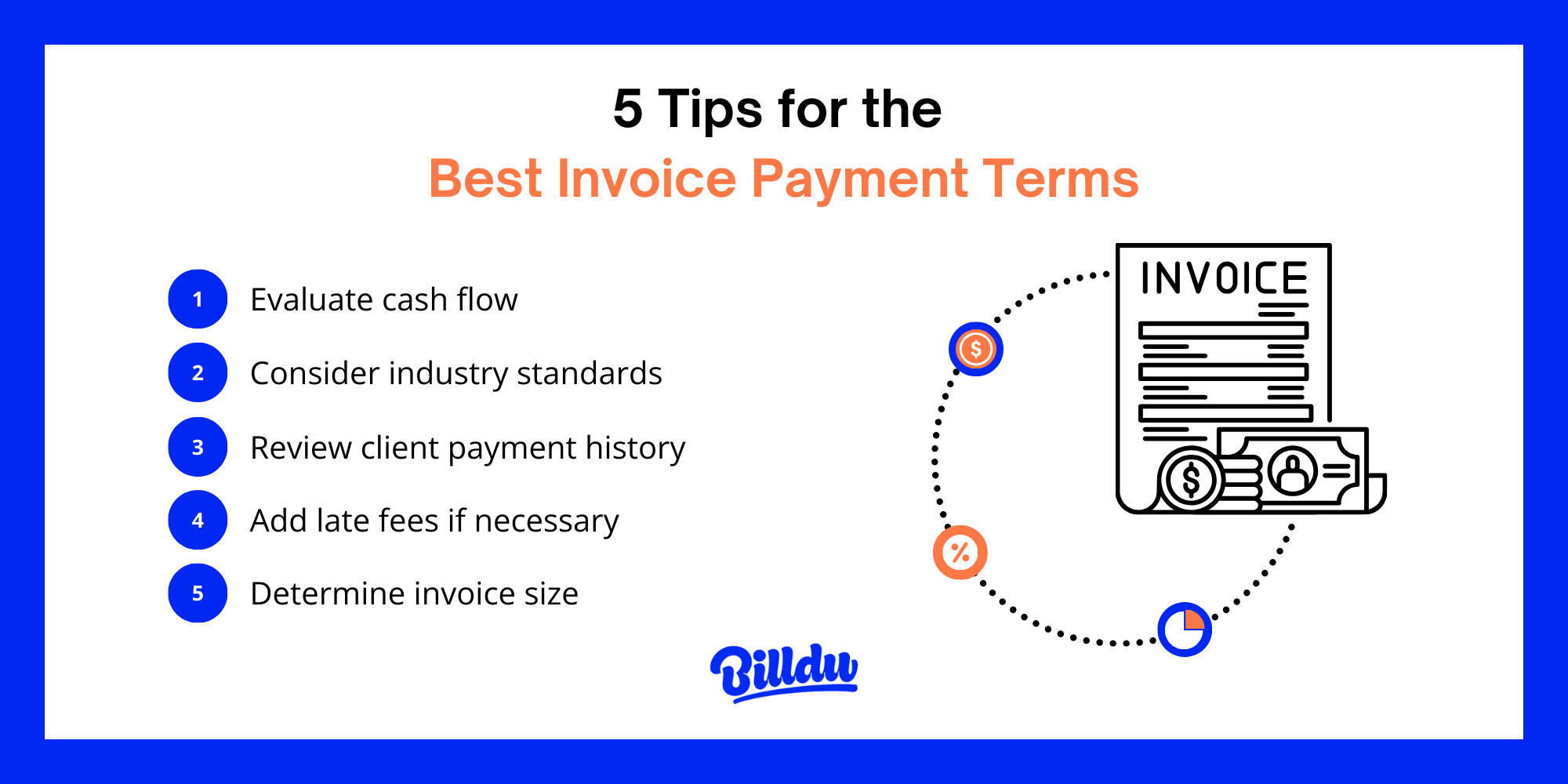

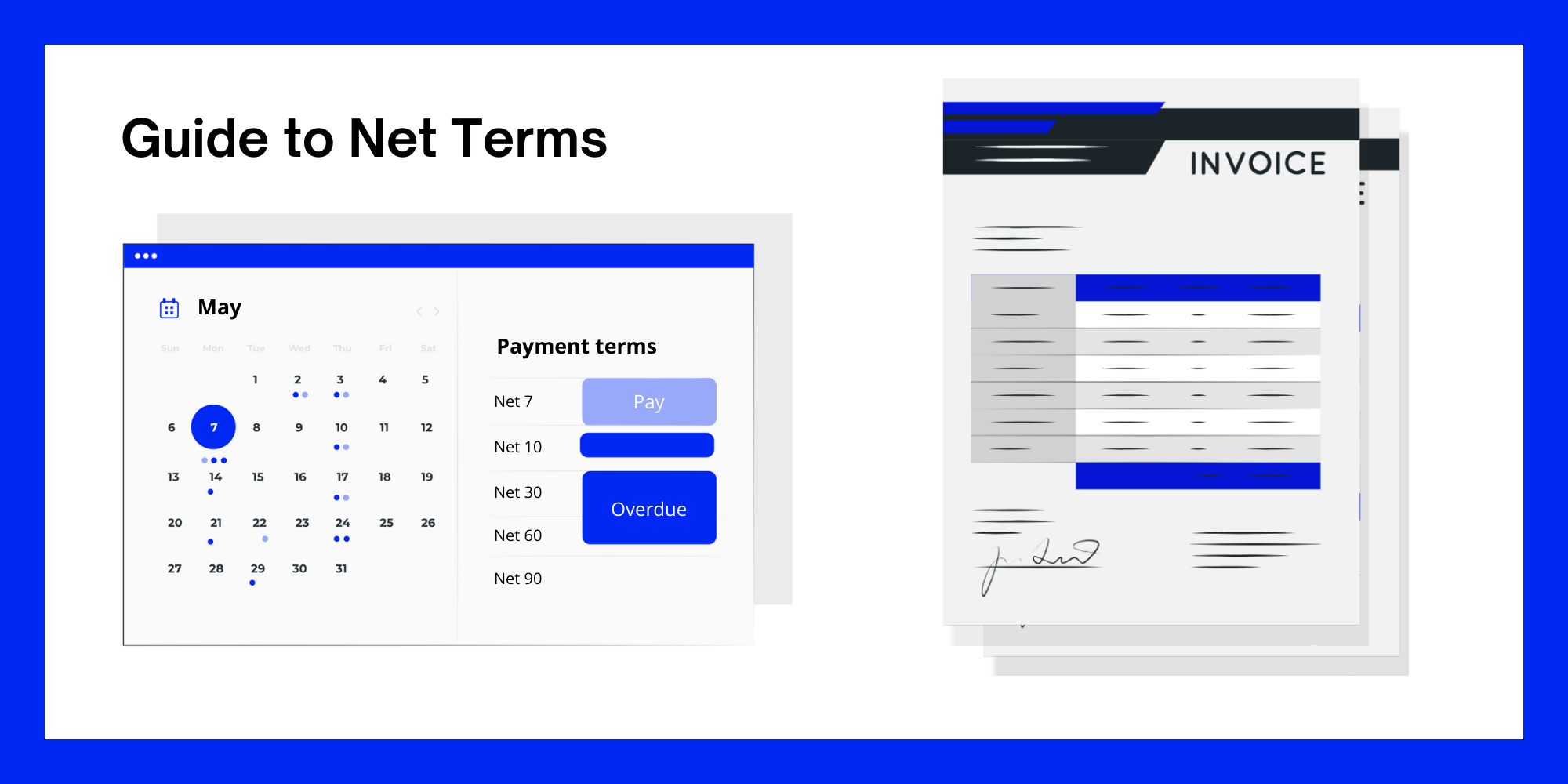

- Understand Common Terms: Familiarize yourself with terms like Net 30, EOM, and PIA to set clear expectations and manage cash flow effectively.

- Set Industry-Standard Terms: Align your payment terms with industry norms, such as Net 60 in construction, to facilitate smoother transactions.

- Evaluate Client Reliability: Review the payment history of clients to choose appropriate terms, reducing the risk of late payments.

- Incorporate Discounts for Early Payments: Offer incentives like 1% discount for early payments to encourage prompt settlements.

- Include Late Fees: Clearly state late fees to motivate timely payments and protect your cash flow.

The Evolution of Invoice Payment Terms

But first, a little history lesson. In the olden days, companies used to physically mail their clients copies of their recurring invoices at the end of each month and give them a couple of weeks to finalize payments. And while this approach is still viable today, it’s painfully slow.

On top of the payment process, it takes time for the physical invoice to be delivered. Then, you need to consider that some customers will want to send you a cheque back instead of a wire transfer or an online payment. And that’s assuming neither of these documents gets lost in the mail.

Thankfully, we have better ways of doing this nowadays. Online invoice templates let you create and generate custom invoice terms and conditions for each customer. Then, all you need to do is send the finished document electronically.

You can also set up options for instant online or card payments to make the process even faster. For even better results, you can include an option that will automatically share a PDF version of the invoice terms and conditions if the customer pleases.

Ultimately, that’ll allow you to get paid faster, prevent anything from getting lost on the way, and even help you cut down on your paper waste.