Receipts have been at the heart of commerce since ancient Mesopotamia. And as is often the case, the more things change, the more they stay the same. From clay tablets to pen and paper to PDF attachments – receipts remain a must-have for businesses of all sizes.

In this article, we’ll cover everything you need to know about receipts, including what it is, how to make one, when to issue them, and much more. So, without further ado, let’s get started with the first question on everyone’s mind.

Key Takeaways

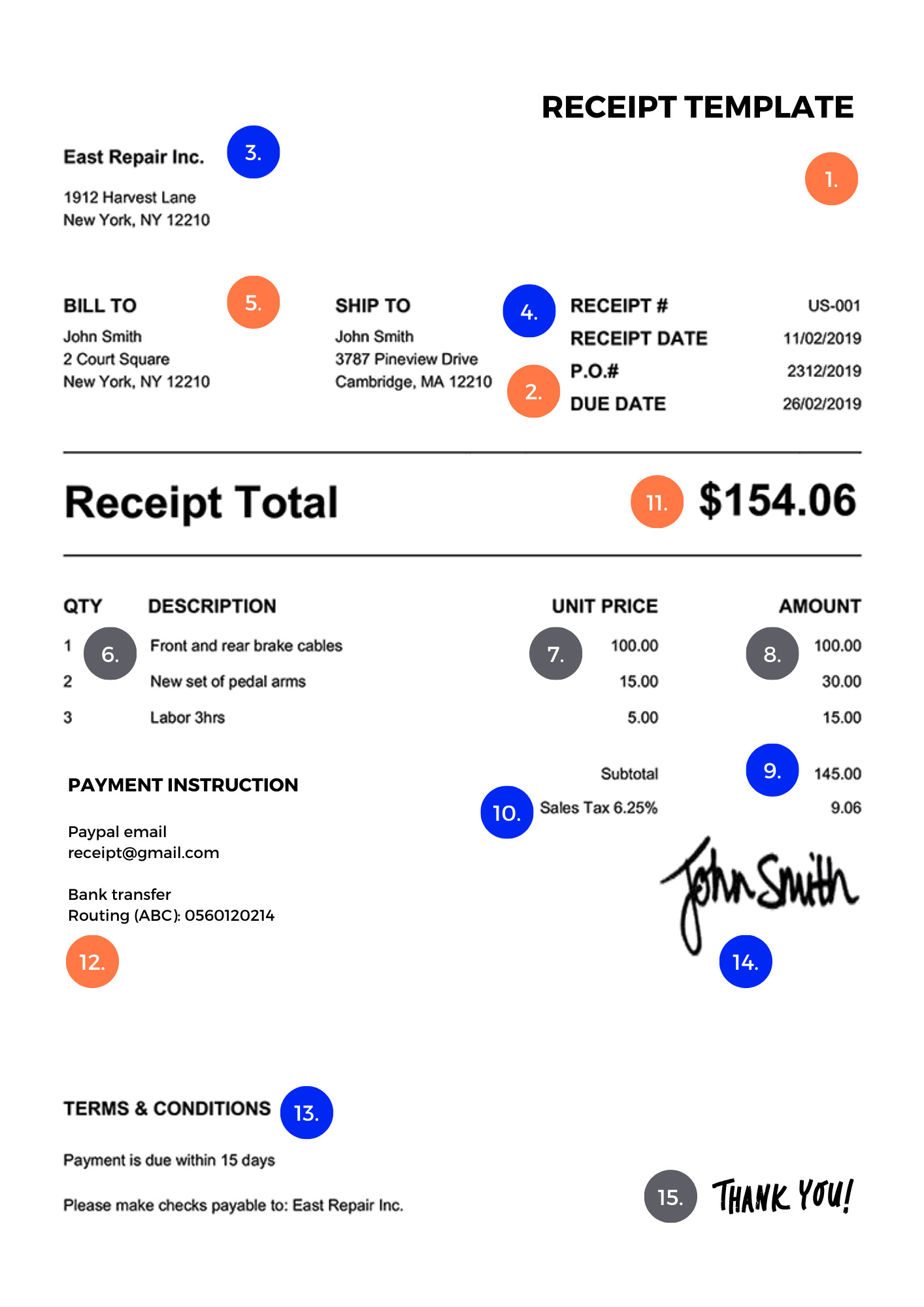

- Essential Information: Include the date, receipt number, seller and buyer details, item description, total amount, and taxes to ensure clear documentation.

- Format Options: Receipts can be handwritten, printed, or digital. Digital receipts are gaining popularity for their convenience and eco-friendliness.

- Legal Importance: Receipts provide proof of purchase, crucial for returns, disputes, and tax records, ensuring accurate financial documentation.

- Customization: Enhance receipts with branding, terms, and refund policies to improve professionalism and manage customer expectations.

What Is a Receipt?

Simply put, a receipt is proof of purchase issued by a business to a buyer following a successful transaction. Depending on what, where, and how an item or service was bought, this can be done digitally or in paper format. Consequently, there is no specific standard set for receipt contents and style.

Invoice vs. Receipt: What’s the Difference?

Although invoices and receipts may look like similar documents due to the information both need to include, there are three main significant distinctions between the two.

Explore the key differences between invoices and receipts.

Aspect Invoice Receipt Purpose Requests payment from a buyer for goods or services provided Confirms payment received for goods or services Timing Issued before payment is made Issued after payment is received Contents Details of goods/services, prices, payment terms, due date Details of goods/services, amount paid, date of payment Function Acts as a billing document, indicating what the buyer owes Serves as proof of payment and completion of transaction Legal Status Can be used to demand payment or serve as a legal document in disputes Serves as evidence of payment for legal and accounting purposes Tax Information May include tax details like VAT or GST Confirms the tax paid as part of the transaction

These include:

- Purpose:

Invoices request payment for items delivered or services rendered.

Receipts acknowledge the finalized payment for items or services. - Time of Issue:

Invoices are issued after fulfillment of an order but prior to payment.

Receipts are issued after fulfillment and successful payment. - Usage:

Invoices are used as a record of sales and a way to track inventory.

Receipts are used as proof of purchase and for business accounting.

Did You Know:

A signed and dated invoice following its payment can act as a simple invoice.

When Do I Need to Issue a Receipt?

As a best practice, you should always issue a receipt to your customers whenever they buy something from you. Naturally, this doesn’t have to be done per item but rather per purchase.