One of the reasons why many people choose to freelance is the income potential. As a freelancer, you may not have the security a full-time job gives, but you can earn more than your employee counterparts in most traditional business models. However, there’s a big challenge when it comes to dealing with clients and managing your earnings in freelancing. To get paid, you have to send invoices to clients actively.

Invoices aren’t a modern concept. Merchants have used invoices since medieval times. During the reign of the Roman Empire, businesses used clay tablets to record sales transactions and invoices. Invoicing has been a critical part of most businesses in the past and present. Therefore, understanding the basics of invoicing is essential to running a successful business.

Top 3 Freelancing Trends in 2024

In 2024, freelancing trends are evolving, driven by three shifts. Firstly, the gig economy is soaring due to digitalization and a preference for flexible work. Full-time freelancers in the US have increased significantly, meeting rising demand across industries.

Specialization is crucial for freelancers, especially in high-demand fields like IT. The shortage of skilled workers globally has led freelancers to fill staffing gaps and add value to companies. Opportunities are abundant for those specializing in IT and AI.

Artificial intelligence is reshaping freelancing, creating new professions and emphasizing soft skills. Demand for AI experts like Machine Learning Engineers is high, underscoring the need for technical proficiency. Soft skills such as communication and problem-solving are also gaining importance.

Why is it Important for Freelancers to have an Invoice?

Why is having an invoice crucial for freelancers? Simply put, it ensures that you get paid for your hard work. Without an invoice, tracking payments and managing finances becomes a daunting task, leading to potential disputes or missed payments.

Additionally, an invoice serves as a professional record of your services rendered, instilling trust and transparency in your client relationships. It’s not just about getting paid promptly; it’s about maintaining professionalism and safeguarding your financial interests in the freelancing world.

Optimize your billing process with top-rated invoicing software designed specifically for self-employed professionals.

Why should you consider using Freelance Invoice Templates?

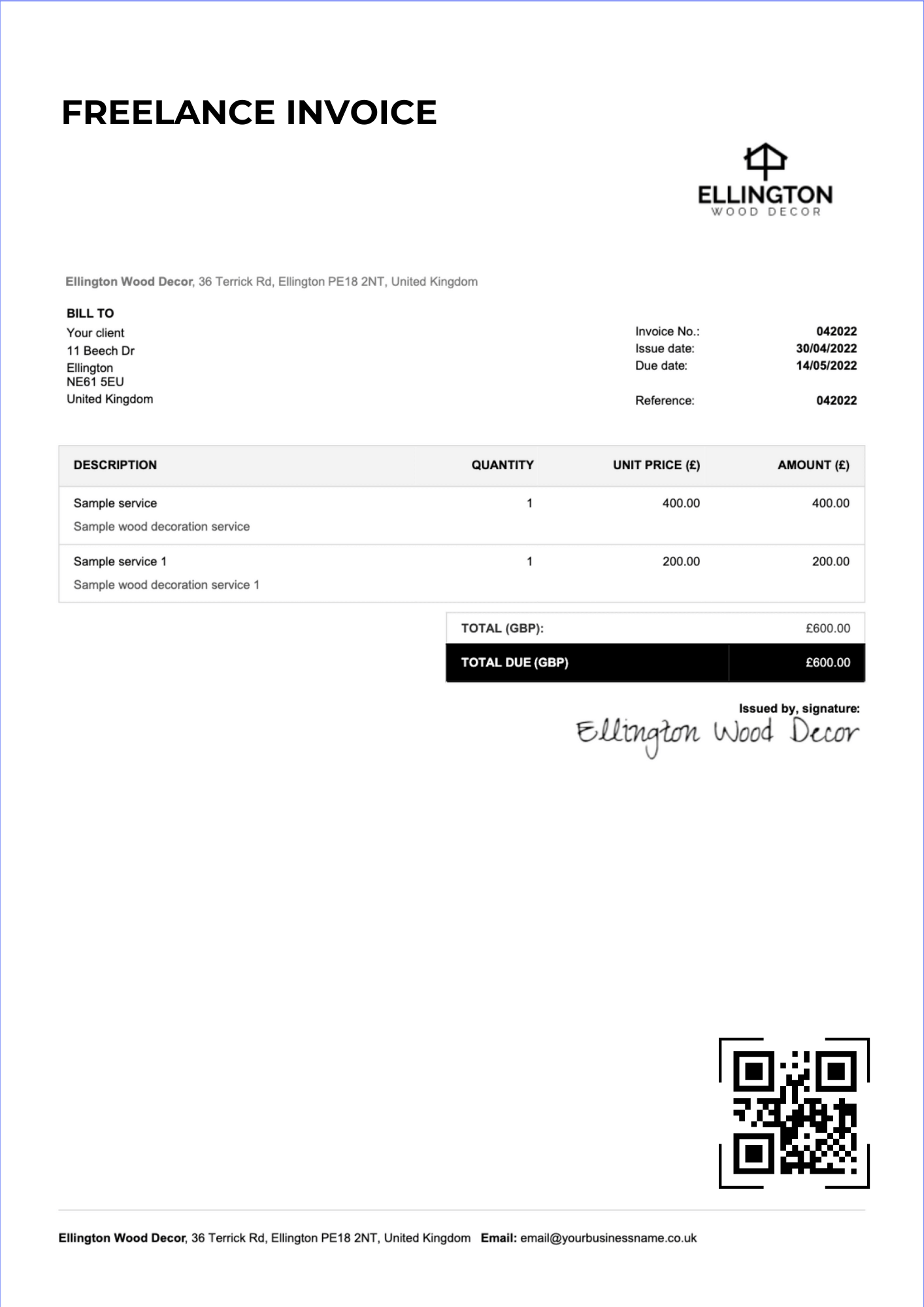

Looking for a seamless invoicing solution? Consider the advantages of using freelance invoice templates. These pre-designed layouts streamline the invoicing process, saving you time and effort. With built-in fields for essential details such as services rendered, rates, and payment terms, these templates ensure accuracy while presenting a polished and professional image to your clients.

Moreover, freelance invoice templates help maintain consistency across your invoices, reinforcing your brand identity. Whether you’re a seasoned freelancer or just starting, these templates provide a convenient way to organize your billing information and present it in a clear and professional manner, ultimately enhancing your efficiency and credibility in the freelance market.

For access to free pages invoice templates, simply click this link to choose your preferred design.

4 Ways How to create Freelance Invoices

Are you ready to optimize your freelance invoicing process for maximum efficiency and professionalism? In this comprehensive guide, we’ll explore four proven methods tailored to your unique freelancing style and business objectives.

1. Create Invoice using Word or Excel

If you’re comfortable with basic document editing, you can create a freelance invoice using software like Microsoft Word or Excel. However, this method often requires extensive formatting and may be time-consuming, especially for those without design skills.

2. Utilize Free Invoice Templates

For a quicker and more polished approach, consider using free invoice templates available online. These templates are pre-designed, allowing you to simply input your information, adjust fonts, and add branding elements. It’s a hassle-free way to ensure a professional-looking invoice.

3. Try Free Invoice Generator

Another convenient option is to utilize free invoice generator found on various websites. This tool typically offers customizable fields and layouts, enabling you to generate professional invoices quickly. With just a few clicks, you can tailor the invoice to suit your needs and branding.

For an invoice generator designed specifically for Australia, simply click the provided link.

4. Explore Invoicing Software

As your freelance business grows, investing in dedicated invoicing software can streamline your invoicing process significantly. While it may not be necessary for beginners, invoicing software becomes valuable as you handle more clients and send multiple invoices weekly. These invoicing platforms offer features like automated reminders, payment tracking, and customizable templates, enhancing efficiency and organization in your invoicing workflow.

Some invoicing software is available for download as a mobile invoicing app.